Washington has confirmed additional duties on Indian goods, raising tariffs to as high as 50%. Markets have reacted sharply, and Indian exporters are bracing for significant order cuts. This article explores the most impacted sectors, India’s response strategy, and the potential implications for Indo–U.S. relations.

Indian Sectors Most Affected: Big picture

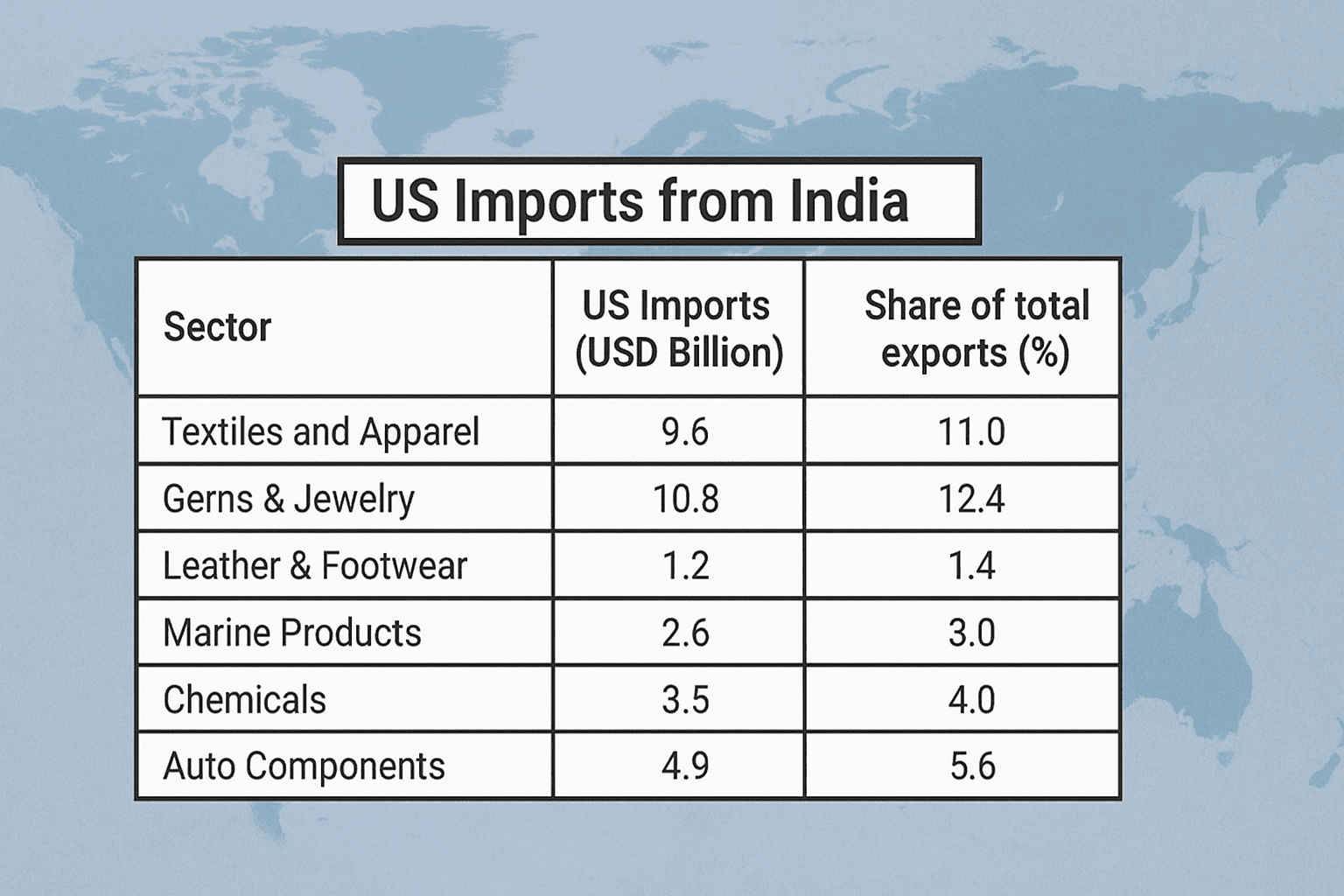

- As of Aug 26, 2025, the US announced an additional 25% tariff on Indian-origin goods, with total duties on some lines reaching ~50%. Roughly half of India’s ~$87B in exports to the US could be affected immediately.

- Textiles & Apparel (~$9.6B; ~11% share). Already face relatively high MFN duties versus many other products; the extra 25% would materially raise landed prices. Expect swift pressure on fashion/basic apparel, with near-term order deferrals and some sourcing shift to Vietnam/Bangladesh.

- Gems & Jewellery (~$10B–$11.6B; ~11%–13% share). High exposure to US retail; margins are thin and price sensitive. Industry bodies warn of notable demand hit and potential re-routing/finishing outside India to mitigate duty.

- Leather & Footwear (~$1.1B; ~1%–1.5% share). Footwear already carries steep US MFN rates on many lines; an extra 25% could render several SKUs unviable unless buyers absorb cost—unlikely in mass-market. Exporters are exploring workarounds (e.g., partial processing in third countries).

- Marine products (~$2.6B; ~3% share). The US is the No.1 market for Indian seafood (especially shrimp). A blanket surcharge would squeeze US importers/processors; short-run demand may drop, with some diversion to China/EU/Japan.

- Chemicals (ex-pharma; ~mid-single-digit $ billions). Many chemical lines have modest MFN rates; a 25% add-on would bite more on commoditized organics/dyes than on specialty grades with tighter supply. Watch for contract re-pricing and increased US interest in Mexico/EU supply.

Auto components (~$7B; ~8% share). Industry estimates say about half of India’s auto-parts shipments to the US would be hit directly, risking a 15–20% near-term volume dip if duties stick. Tier-1/2s may fast-track “China+1” style US-adjacent assembly to preserve eligibility

IImpact on Indo–U.S. Relations

Washington’s decision to raise tariffs on Indian goods to 50% has added fresh strain to the Indo–U.S. economic partnership. The move, aimed at protecting American manufacturers, is being seen in New Delhi as a setback to the growing trade and strategic ties between the two nations. Analysts warn that the tariff hike could overshadow recent efforts to deepen cooperation in defence, technology, and clean energy. While both sides remain committed to the broader strategic partnership, trade tensions of this scale risk slowing progress on free trade talks and could push India to look for new markets in Europe and Asia. Diplomats say negotiations are likely in the coming weeks, but if no solution emerges, the issue may escalate to the World Trade Organization, testing the resilience of bilateral ties.

Possible Options for India

To manage the impact of tariffs, the Indian government is likely to open talks with Washington to seek relief and protect trade ties. At the same time, New Delhi may offer support to affected exporters through incentives and easier credit. Experts say India will also speed up trade deals with the European Union and the UK to reduce its dependence on the US market. If negotiations fail, India could take the issue to the World Trade Organization and even consider selective counter-tariffs. The government is also looking at ways to cut production costs at home to keep Indian goods competitive.

Conclusion

A 50% U.S. tariff is a major trade shock for India’s MSME-driven export sector. The way forward involves urgent diplomatic engagement, domestic support measures, and strategic diversification to minimize long-term vulnerability.